Services

Private equity consulting

Data-driven expertise to accelerate value creation

Protect investments with objective talent decisions at every step.

Objectively assessing the strengths and potential gaps of a portfolio company’s leadership team is key to evaluating the company’s ability to deliver on the Value Creation Plan (VCP) and the deal team’s investment thesis. We integrate data-based leadership decisions from due diligence to exit.

Accelerated Performance Group was founded in 2020 specifically to support private equity clients. Our team brings decades of experience working with investors, deal teams, and portfolio company management teams to accelerate their VCPs.

From due diligence to management team effectiveness, we can apply our full suite of services to identify, onboard, and deploy the leadership talent you need.

Accelerated Performance Group collaborates with everyone involved to manage leader transitions. For example, we can help identify leaders who’ll excel at achieving the VCP, source qualified internal and external candidates, minimize disruptions, and accelerate a successful transition.

“80% of portfolio company underperform due to waiting too long to make management team member changes.”

Source: Bain

Key benefits

Inform decisions

Make data-based leadership decisions at every stage of the private equity process.

Increase knowledge of leadership team members’ strengths, gaps, and critical thinking skills.

Save time by evaluating candidates based on specific leadership goals and needs.

Reduce risk

Reduce risk and increase chances of successful business growth and execution of the VCP.

Address leadership challenges before they become larger problems.

Increase transparency and collaboration between management team members and investment team members.

Maximize ROI

Accelerate leadership effectiveness during and after the transition.

Connect business goals and the VCP with leadership team member roles and responsibilities.

Maximize ROI on the investment.

“Charles of Accelerated Performance Group worked closely with us to identify the right leaders to hire and coached the executive team to gel quickly. We have now assembled the ‘dream team’ to lead our investment.”

- Managing Partner, Private Equity Firm

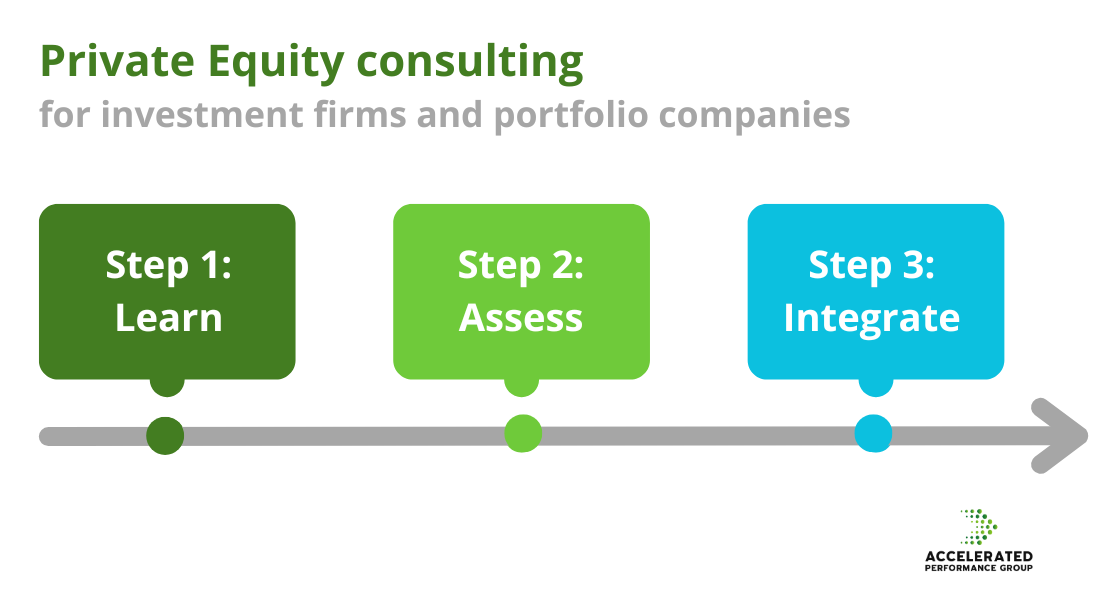

Program overview

Since every investment firm and portfolio company is different, we’ll combine specific leadership performance services to meet your needs. Our programs always include valid assessment techniques and strategic support from experts in leadership performance.

Step 1: Learn

Private equity firm’s investment goals and metrics

Portfolio company’s industry and organizational structure

Company’s leadership requirements and key operational priorities

Company’s Value Creation Plan (VCP)

Map leadership goals and role requirements to the VCP

Step 2: Assess

Conduct leadership assessment(s).

If needed, conduct executive search for leaders who meet the requirements

Summarize results and recommendations

Step 3: Integrate

Leadership team effectiveness program and workshops

Onboard new leaders

Measure impact

Define next steps

“64% of recent deal failures were caused by the management team lacking requisite skills to execute the value creation plan.”

Source: Bain

Get data-driven expertise to accelerate value creation

Protect private equity investments with objective talent decisions at every step.

✔️ Inform decisions

Gain clear, data-driven insights into a leadership team’s strengths and gaps.

✔️ Reduce risk

Solve leadership challenges early to ensure VCP success.

✔️ Maximize ROI

Align leaders’ strengths with business goals for accelerated performance.